Today in Real Estate

Today in Real Estate is a page dedicated to giving the public updates on current Real Estate issues and market conditions. These reports are generated from the Metro MLS, who covers all of south eastern Wisconsin. For some reason they seem to concentrate on Milwaukee in their reports. Which is normally the largest market in Wisconsin, but lately has not represented the what is happening today in Real Estate in other parts of Wisconsin. I guess when you get stuck in a habit, it is hard to get out of it. I wish they had more news about what is happening today in Real Estate in other parts of the state like Sheboygan, Plymouth, Fond du Lac, Green Bay, and West Bend. But we have to take what we are given with a grain of salt. I will make mention of what I see in local markets, and of course, when it comes time for you to buy or sell any Real Estate, I will generate a personal report for you in your local area. That is the only way to do business.

Thanks to the Metro MLS for their reports. I am paying for these, so I may as well share them. I will also post reports from the WRA, Wisconsin Realors© Association, and other local offices when they are available.

Thanks to the Metro MLS for their reports. I am paying for these, so I may as well share them. I will also post reports from the WRA, Wisconsin Realors© Association, and other local offices when they are available.

If you have any questions, feel free to give me a call, or send me a message. If you want to find out what your house and property is worth in the market today, you can call, or send a message on my form page.

This is the BEST market update video I have seen. You have to watch this one. Make this kid famous. Share this.

[contentcards url=”https://www.facebook.com/joneshomecollective/videos/2266426876943998/?t=0″ target=”_blank”]

|

|

|

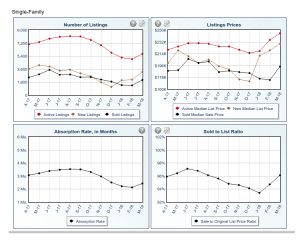

percent to $223,000. Days on Market was down 25.6 percent to 32 days.

Buyers felt empowered as Months Supply of Inventory was up 6.5 percent to 3.3 months.

|

All data for the market reports comes from the Multiple Listing Service, Inc. and is powered by 10K Research and Marketing. You can follow this link: Metro MLS Market Updates or visit www.metromls.com.

The views and opinions expressed in this article are those of the authors and should reflect only on trends that affect the economics of real estate.

Please contact your respective MLS with any questions. You may also follow our updates at http://twitter.com/metromls. Metro MLS members can call the Help Desk at 414-778-5450 or email support@metromls.com.

|

|

All data for the market reports comes from the Multiple Listing Service, Inc. and is powered by 10K Research and Marketing. You can follow this link: Metro MLS Market Updates or visit www.metromls.com.

The views and opinions expressed in this article are those of the authors and should reflect only on trends that affect the economics of real estate.

|

|

All data for the market reports comes from the Multiple Listing Service, Inc. and is powered by 10K Research and Marketing. You can follow this link: Metro MLS Market Updates or visit www.metromls.com.

The views and opinions expressed in this article are those of the authors and should reflect only on trends that affect the economics of real estate.

Please contact your respective MLS with any questions. You may also follow our updates at http://twitter.com/metromls. Metro MLS members can call the Help Desk at 414-778-5450 or email support@metromls.com.

|

|

All data for the market reports comes from the Multiple Listing Service, Inc. and is powered by 10K Research and Marketing. You can follow this link: Metro MLS Market Updates or visit www.metromls.com.

The views and opinions expressed in this article are those of the authors and should reflect only on trends that affect the economics of real estate.

|

|

|||

|